How to do Market Research for your SME

Market research is critical to the success of any business, especially for small and medium-sized businesses (SMEs). However, SMEs often don't know where to start when it comes to doing market research.

In this article we will see in detail how to conduct effective market research for your SME in a simple way and with a limited budget. We will see:

- What is market research and why is it important

- How to define your target customers

- Where to look to optimize your offer

- The data sources you can use

- The most effective methods for collecting data

- How to analyze the collected data

- How to use search results to improve your business

I hope this complete guide will be useful to you to better understand who to sell your products to and how to reach new potential customers. Let's begin!

What is market research?

Simply put, market research is the process of collecting and analyzing information about your potential customers, the demand for your products or services, and your competitors . The goal is to better understand the needs and behaviors of your buyers so you can make informed strategic decisions as a business owner. For example, market research can help you:

- Develop new products and services that meet customer needs

- Determine the optimal price of your products

- Choose the most effective sales and marketing channels

- Identify new business opportunities

- Understand how to differentiate yourself from the competition

In the real world, well-done market research reduces risk in your strategic decisions and allows you to better allocate time and resources. With these premises one might wonder why in Italy it is such a rare practice or so poorly managed in SMEs.

Unfortunately, the answer is always the same: in our country the marketing culture is low, and in the last ten years the fuffaguru lovers of colorful theories have made it even more ugly.

Why is market research important for an SME?

Many entrepreneurs think that market research is only for large companies, but this is not the case at all. Indeed, it is even more important for a small or medium-sized business . Definitely more important, since you can afford to make fewer mistakes.

SMEs have fewer resources to invest in marketing and advertising than large companies. For this reason, they need to target the right customer target and products and services that are consistent with market demand right away.

Furthermore, the continuous change in consumer habits and technology make it essential to collect updated data on your customers. In short, market research is essential to ensure that every euro invested in marketing leads to the desired result.

Define the customer target

Market research is first and foremost an understanding of who our customers are and what they want.

A rather old and partially outdated approach is to create "buyer personas" , i.e. prototypical customer profiles to talk to. In the book " Digital Deep Marketing Remastered " available on Amazon we have addressed in detail the many risks and biases underlying the Buyer Personas approach and this is not the place to go back to the discussion, we refer you to the book, a perfect marketing manual for SMEs.

Here it is enough for you to know that Buyer Personas do not respect many statistical laws on the variance of the target , and where there is no statistics there is no science. And where there is no science, we advise you not to proceed because you enter into point of view and legends .

In general you will have better luck assuming that your target (audience) is incredibly heterogeneous but with some elements common to the core group of buyers. You can then start your market research by trying to obtain demographic and psychographic details such as:

- Approximate age and gender

- Occupations

- Geographical areas

- Interests and hobbies

- Values

- Aspirations

- Frustrations

Don't overcomplicate this collection and don't create tables that are too complicated and full of data. It's no use.

The more you identify obvious classifications, the more your marketing will thank you.

For example, a quality tie will largely have a male target interested in careers and partially a female target interested in giving valuable gifts to friends, relatives and companions . It takes common sense in marketing, don't let yourself be carried away by the pleasant but without any statistical sense game of thinking you can define ideal customer profiles. You can not. You are not gods and statistics will fight against you.

Mathematically you will exclude valuable customers!

In the suggested way, you can instead create useful profiles of potential customers and think about what their needs are. This will allow you to understand your market demand very well.

Understand what to propose

Many (almost all) companies and entrepreneurs think based on the offer, that is, they start from products and services they already have and look for the best way to place them on the market and sell them. Okay, this isn't marketing. In no way. In fact, it's the exact opposite of marketing. This is, at best, an old-fashioned and very outdated business approach.

It is the market that tells us what we should propose, not the opposite!

So market research also helps us to correctly define what we can produce/offer in order to make it compatible with what people already want . If you believe the nonsense about "creating new markets / needs / categories / niches" get in line with the amount of desperate entrepreneurs who call us weekly hoping to be saved after having implemented these absolutely suicidal strategies for months and having ruined their companies.

You have no opportunity to create new markets. You are too small. And, for the love of Zeus, don't get your head around working with niches and specializing too much: you won't have enough potential customers! Every single piece of scientific marketing evidence confirms the importance of never narrowing the customer target too artificially. Many fuffagurus with little real experience in the discipline use the phrase "specialize or die". While the literature and studies on real companies lead us to the almost opposite conclusion: " specialize (too much) AND die" .

Where to start then?

We must start by researching relevant trends such as:

- Growth rates for certain products/services

- Changes in market shares

- Sales forecast

- Supply and demand analysis

These trends tell us where customer demand and interest and therefore potential opportunities are heading . For example, if tech wearables like smartwatches are growing 20% a year, you could create related apps or accessories . Or you could identify underserved markets where demand exceeds supply , suggesting possibilities for new players.

Also look at your competitors, in particular:

- Range of products/services offered

- Pricing and business models

- Distribution channels used

- Messaging and positioning

- Customer reviews and perceptions

This allows you to identify what works best in their offering to do better, or overlooked market spaces where you can position yourself. For example, if competitors forget the over 50s, you could also work on this specific target. Or you could offer a cheaper and more basic version of a premium product already on the market and successful . In short, studying the competition highlights new opportunities for innovation and differentiation.

Data sources

Now that you have a clear idea of your goals, it's time to collect data. Here are some of the sources you can use:

- Internal data: The data you probably already have available is invaluable. Analyze the information you have about your existing customers - purchase orders, demographics, social media interactions, etc. For SMEs it is the easiest and cheapest way to get started.

- Secondary research: There is a lot of already published data and reports that you can use. Reliable sources include government bodies, trade associations, universities and research institutes. Much information is available for free online. You can spend a few hundred euros: it's worth it.

- Primary research: If you want to collect specific data that doesn't already exist, you can conduct your primary research through surveys, interviews, focus groups and field observations. They require more effort but give you information tailored to your business.

Primary research

Choose carefully which research methods you want to use based on the type of information you need and the resources you have available. Here are some tips:

- Surveys: an easy and economical way to collect data from a large number of people. Use online platforms to create and distribute surveys quickly. Make sure you ask targeted questions.

- Interviews: More in-depth than surveys, interviews allow you to ask specific questions of participants. You can interview existing customers, prospects or industry experts.

- Focus group: A moderated group discussion with 6-10 participants from your target audience. Useful for exploring complex topics, brainstorming new ideas, and understanding emotional reactions. Very expensive, to be done only in specific cases.

- Field observation: See directly how customers interact with your products, stores or website. Useful for understanding unsolved problems or new opportunities. It seems like a trivial practice, but we assure you it can make a difference. Nothing surpasses contact with reality.

- Web data: Analyze your website traffic with Google Analytics or use tools like Google Trends to identify new search trends.

Choose a combination of these methods to obtain both quantitative (numbers and percentages) and qualitative (opinions and reasons) data.

Analyze and interpret data

Once you have collected the data, you need to organize and analyze it to gain useful insights for your business.

- Clean the data: Make sure there are no errors or outliers. Use spreadsheets or analytical software. In our experience, this is where even major companies fail. Try to have people in the team who are sensitive to statistics and data analysis. Biases and spurious correlations are always around the corner.

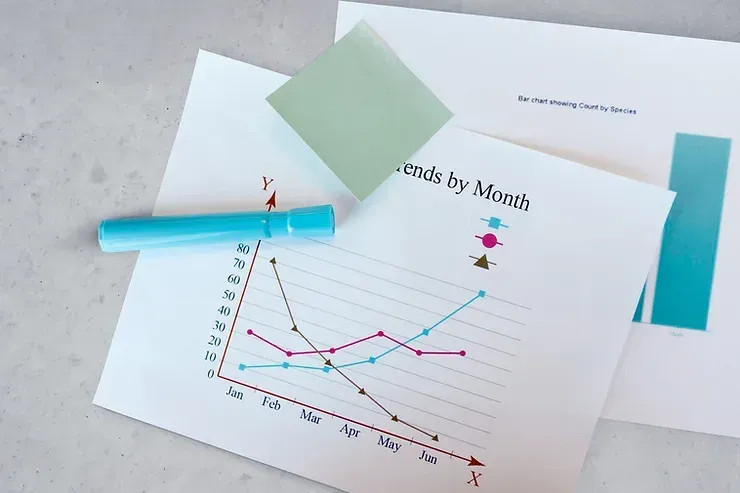

- Analyze: Organize data into tables and graphs. Calculate key metrics like mean, median, and standard deviation. Understand distributions. Identify patterns and trends.

- Interpret: make sense of the results that emerge. What do they mean for your business? What opportunities or problems do they highlight?

- Synthesize: Create a concise report with key findings, your interpretations, and concrete recommendations on what to do.

Then share the report with the whole team so that the research results lead to strategic decisions and concrete actions.

Use the results

What's the point of all this effort if you don't actually use the search results?

Here are some ways to make the most of the insights you gain and grow your business:

- Develops new products and services that respond to emerging customer needs

- Improve marketing and sales: better segment prospects, personalize copy, choose new channels

- Optimize prices: increase or decrease them based on customers' spending availability

- Improve customer experience: respond to emerging frustrations, simplify processes

- Expand your market: Enter new geographic areas or customer segments

- Strengthen your competitive advantage: differentiate yourself where competitors are weak

In short, well-done market research with concrete results is the foundation of a winning strategy for your SME.

We trust that this guide has been useful to you! If you need a hand conducting market research or analyzing data, please contact us . At Deep Marketing, our team of experts can support you at all stages, saving you valuable time and resources.

Where and how to learn more

We understand that the topic is huge, that's why we have selected further very interesting readings to continue your study on market research with the best sources.

Articles from the best players on the market

- https://www.sba.gov/business-guide/plan-your-business/market-research-competitive-analysis

- https://www.salesforce.com/ca/blog/how-to-determine-your-small-business-s-target-market/

- https://www.forbes.com/sites/forbesbusinesscouncil/2022/10/20/seven-ways-to-maximize-effective-communication-in-small-businesses/?sh=3e699085342f

- https://www.similarweb.com/blog/research/market-research/small-business-market-research/

- https://blog.hubspot.com/marketing/market-research-tools-resources

- https://www.salesforce.com/resources/articles/how-to-conduct-market-research-small-business/

- https://www.activecampaign.com/blog/how-to-do-market-research-for-small-business

- https://www.adobe.com/express/learn/blog/target-audience

Operational insights into specific aspects of market research

- https://newitymarket.com/business-services/how-to-identify-your-target-audience-as-a-small-business/

- https://www.score.org/resource/blog-post/5-ways-improve-communication-within-your-small-business

- https://buffer.com/library/how-to-do-market-research-for-small-businesses/

- https://www.business.com/articles/identify-your-target-audience/

- https://www.indeed.com/hire/c/info/business-communication-strategies

- https://www.bdc.ca/en/articles-tools/blog/how-conduct-market-research-small-businesses

- https://www.skillsyouneed.com/rhubarb/communication-for-small-business.html

- https://ventureandgrow.com/audience-targeting-for-small-businesses/

- https://www.indeed.com/career-advice/career-development/market-research-for-small-business

Deep Marketing è un'agenzia marketing, comunicazione e pubbliche relazioni di livello internazionale con sede a Verona e Praga.

Deep Marketing Srl, P.IVA: 04833130232

Iscriviti alla newsletter